Okay seriously, who ever said money doesn't buy happiness isn't fully correct. Correct in the sense that family is happiness, but if I didn't need money so bad lord knows I would be cuddling and playing with my little love bugs every chance I got, oh and I'd hire a house keeper that does laundry.

Times are tough for everyone and we have not escaped that. I am at a place I swore I would never be again. We have credit card debt... GASP! We worked soooooooooo hard to pay off some old debt about 6 years ago and since then we never carried credit card debt. Well, here we are again, and I must say it is NO where near as bad as before.

Before we had kids our finances were pretty cushy. If we wanted to go out to dinner, we wouldn't think twice. Did we randomly pick up and go on vacation at the drop of a hat, no. However, if we saved for a couple months, off we would go. We never really lived paycheck to paycheck and if we really wanted something we would save for a bit then get it.

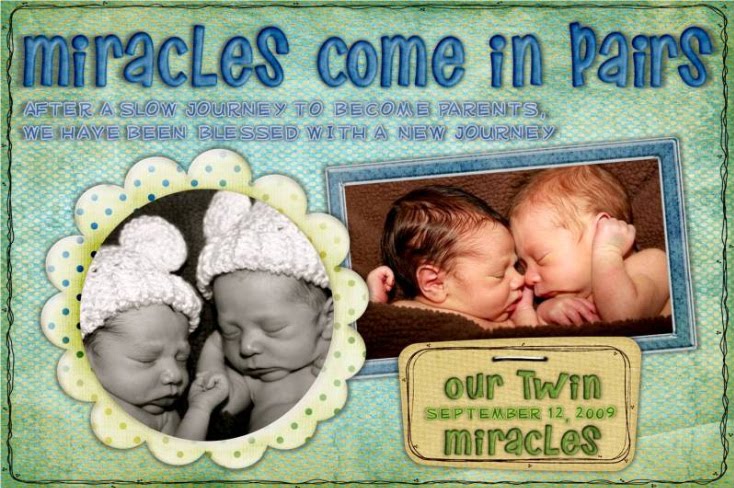

Now fast forward $30k in medical bills, 28 weeks on disability pay, a mortgage which sky rocketed to $3,400, cutting my hours at work, and oh.. um two children. Not to mention not sacrificing as much as we should have been.

Over the course of two years we have managed to fall slightly off the wagon again, the wagon I swore I would never be on and here we are. I must say it isn't all too bad, but it's NOT where I want to be.

Can I fix it? Yes I already HAVE. I have been working at it and have paid down a large chunk and then finally decided that digging into savings for the other chunk makes the most sense. The debt will be gone next month and the sacrifices I have been making for the last month or so will stay in place. The debt wasn't huge, about one month salary and it took about a year to get that high, we would pay a chunk, but it seemed we just never had enough to just once and for all get caught up. The point isn't how large or small the debt was, it was the point that I SWORE I wouldn't do this.

September was expensive! A move, which then meant bills at two houses, some new things for the new house, My BFFs b-day, another close friends bday, three kid bdays, 3 baby showers, Noah and Aaden's TWO parties, and now Gabe's bday. We made one last splurge for Gabe's bday... a new BBQ, and dinner at Benihana's, which wasn't all too expensive because he had a $30 certificate. We hadn't planned on the BBQ splurge, but when my husband finds something he REALLY wants, it's hard to change his mind. So, when my Grandma gave him bday money early and my Mom and Step-Dad agreed to buy the accessories, I caved and agreed to let him purchase the BBQ for his bday. Only because of the bday money and because our old BBQ which we got when we moved into our last house was charcoal only, making it hard for me to pop outside and grill up a few pieces of chicken. Well, the new one is combo and oh so nice. Now I am trying to convince Gabe to let me put the old one on craig.slist, which is my new favorite thing to do. I have been selling all kinds of stuff to make some money to pay down that bill. I have also been taking things to consignment shops and almost fell over last week when I had $140 credit at a local consignment shop.

Along with de-cluttering and selling I have also been watching a couple kids, which includes my babysitters son on days off or in the evening to work off some of the hours I accumulate with her while I am at work. I have also been budgeting and changing the way I make purchases. I am trying to use cash as much as possible, because for me it is harder to part with cash than a swipe of a card. Since the bubbies are on milk we go through a gallon every two to three days, my new grocery shopping trick is to walk to the store and only bring $30 cash. That way I can only buy what we really need. #1 because I only have $30 and #2 because we are in the stroller or wagon we can't buy too much. This allows our grocery budget to be $300 a month, and then we usually make one Costco trip during the month as well, but now that we aren't on formula, the Costco trips will probably be less. I will only buy produce which is on sale, and will not buy any name brand products or meat that isn't on sale. I have also changed grocery stores and will only use the lower priced grocery store or super Wa.lmart. So far I can really notice the difference and it has REALLY forced me to use the things in the pantry or freezer.

Switching from a gallon of milk every two to three days vs. the can of formula is a huge and wonderful $17 savings every few days. I have also been giving the kids more of what we eat and not buying the expensive toddler foods. And while I totally love Mott's for tots apple juice, I have been buying generic and watering it in half. It then only costs me $1.50 for two times the juice vs. the $4 it would be for that amount of Mott's for Tots. Along with this comes coupon clipping, which I try to use when the product is on sale. I have also been walking instead of driving when possible, cutting back on prescriptions and the use of paper towels and paper plates. I changed the watering hour of our lawn so that the amount of time could be reduced, I try not to use the AC when at all possible, and am also trying to not run the dishwasher as often.

Thank goodness for wonderful friends and family for the generous gifts for the boys bday. We got 4 cases of diapers, gift cards, money for the boys college account, and a WHOLE 18 month wardrobe. Along with some great toys, just the right amount of toys. Their favorites include the wagon, little tikes car, lawn mower from Uncle Chach & Aunt Jodi, a cell phone from Auntie Drea, and we could never forget the CAT dump truck and tractor which are hands down one of their favorite toys. But as for the best thing they got from their party, the two mylar balloons still floating around. Who would have thought? (Oh and YES of course B-day blogs are coming.)

The gift cards came in handy. I stocked up on their shampoo, these darn gerber raviolis in water they love, fruit, wipes, juice, sippy cups, crackers, frozen waffles, tylenol, diaper genie refills (which I might add will probably be my next cut, those darn refills are $6 every week in a half.)

Could we make it without making these sacrifices? Yes, but why?

Could we live like we used to if I went back to work full time? Yes, but why?

I am willing to give up a whole heck of a lot for these two precious days I get at home with my kiddos. The two days I get to feel like a Mommy. The two days I spend cooking, cleaning, running errands, and taking the kids to the park. These days along with an occasional family day are what I live for. No amount of money or comfortableness can make up for the feeling I get just being the Mom.

My two days are something I would make the sacrifices for. I also wouldn't give up the boys monthly contribution to their college accounts, a chunk going into my retirement account, my iphone, my car which makes me smile every time I load my kids in it, and a cheap bottle of wine every few days.

So there you have it. Money can't buy happiness, and money isn't everything, money would make things easier, but why? A little sacrifice is good for the soul and it shows the boys that their Daddy and I work hard for the things we have. Nothing is handed to us and while it would be nice to be at home with them everyday and it would be nice to buy things without much thought. Those are not the values we want to instill in our boys. I want the boys to know we work to have nice things, but we sacrifice for more family time and for our and their futures.

1 year ago